The Evolution of Retirement

The Evolution of Retirement

Retirement, as we know it today, is a relatively modern concept that has transformed the lives of Americans, thanks in part to investment funds like mutual funds and, later, ETFs. Before the twentieth century, the average American had limited investment options. Retirement, or the ability to stop working and remain financially comfortable, was a privilege largely reserved for the wealthy or those with employer-provided pensions. But through the creation of pooled investment products, retirement became more than just a pipe dream—it became an attainable goal for nearly all Americans and the backbone of financial planning.

Democratizing Retirement

Mutual funds and ETFs allow individuals to pool their money together and invest in a diversified, professionally managed portfolio—even if they have limited resources. These institutions have played a significant role in democratizing retirement savings and empowering Americans to have a secure financial future. Private investments play a vital role alongside Social Security in supporting retirees.

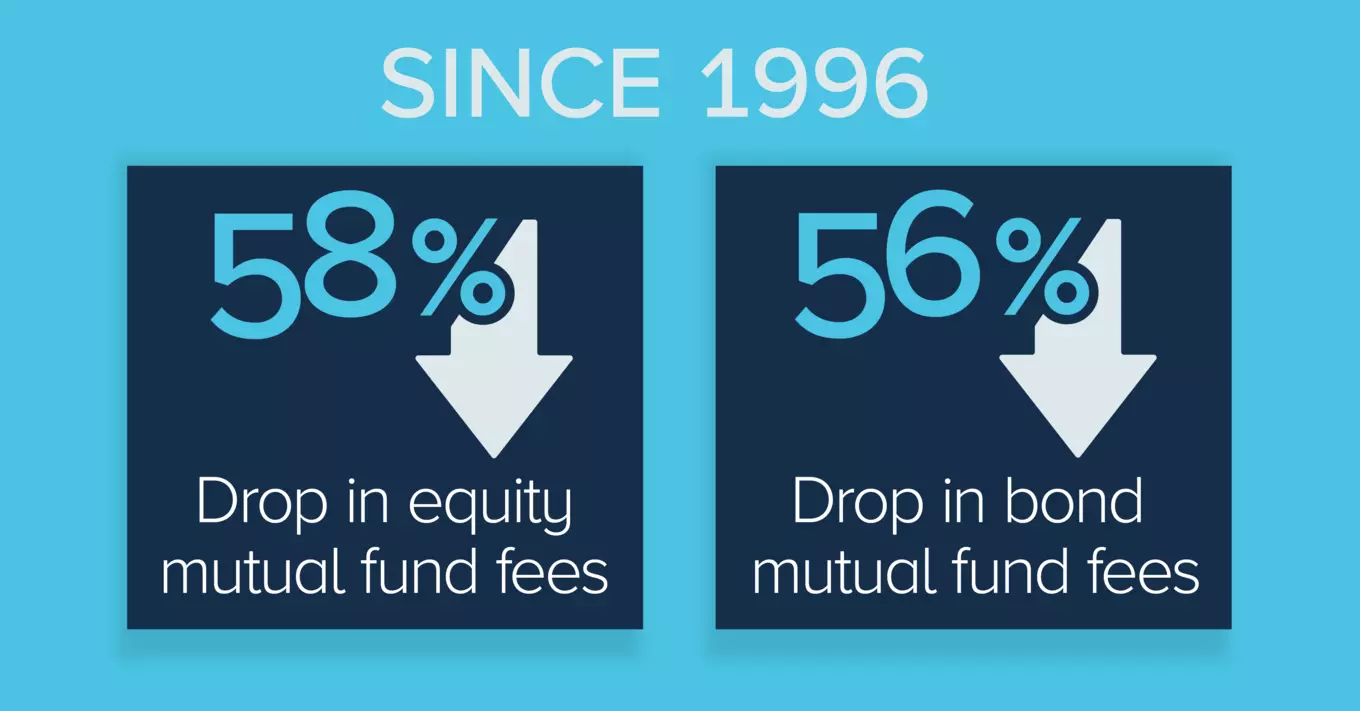

To better understand the progress made in retirement planning, we can draw a parallel with the evolution of technology. Do you recall when flat-screen TVs were an expensive luxury item? Today, they are a fraction of the cost and there is one in almost every home. Similarly, the fees associated with retirement investing have fallen significantly over time while the range of investment options has exploded. Today, Americans can invest in funds across asset classes, sectors, and geographies—not to mention different styles and approaches—in accordance with their goals and preferences.

Meeting the Needs of a Changing Society

The rise of 401(k)s, IRAs, and other voluntary retirement plans that invest in funds has facilitated financial stability amid dramatic changes in American life. Gone for many are the proverbial days when individuals would work for a single company for 30 years. Defined benefit pensions have also generally disappeared or come under stress alongside increased life expectancy and major economic shifts.

In the modern era, voluntary retirement plans allow people to change careers and employers more frequently while maintaining greater control over their retirement savings. By having portable retirement accounts, individuals can accumulate savings throughout their careers and build a nest egg to last the rest of their life, with the added potential to build generational wealth.

A Source of Security

Retirement, when approached with proper planning and investment, offers individuals the opportunity to enjoy the fruits of their labor and live comfortably during their golden years. What was once an exclusive privilege has evolved into a reality for many. Thanks to advancements in retirement planning, easy access to diverse investment options, and the flexibility to adapt to changing work dynamics, retirement has become a source of hope and security for millions of people.

Secure Financial Future is committed to safeguarding the decades-old integrity and professional management of investment funds. Through education and advocacy, Secure Financial Future can help every long-term investor take an active role in understanding and choosing the financial products they use every day to save for the future.